Introduction: Why Legal Defense Matters Immediately

An insurance fraud attorney can be the difference between a dismissed case and a life-altering conviction. Fraud allegations involving insurance claims are aggressively investigated and prosecuted, often long before the accused fully understands the seriousness of the situation. Whether the issue involves health coverage, auto policies, disability benefits, or property claims, even a simple misunderstanding can escalate into criminal charges. Knowing how these cases work—and how legal defense strategies are built—can help you make informed decisions when your future is on the line.

The Complexity Behind Fraud Investigations

Insurance-related fraud cases are rarely straightforward. They involve detailed documentation, financial records, statements to adjusters, and sometimes federal agencies. Without skilled legal guidance, individuals can unintentionally harm their own defense. Every document submitted and every recorded statement may later become evidence, which is why understanding the investigative process is critical from the very beginning.

Understanding Insurance Fraud Charges

Insurance fraud generally refers to intentionally deceiving an insurer for financial gain. While the concept may seem simple, the legal definitions are complex and vary by state and federal law. Some cases involve exaggerated claims after accidents. Others involve staged incidents, falsified medical reports, or misrepresented property damage. In more serious cases, prosecutors may allege organized schemes involving multiple parties.

How Prosecutors Attempt to Prove Intent

What makes these charges especially dangerous is that prosecutors must prove intent. This means they need to show that the accused knowingly attempted to deceive an insurance company. However, intent can be inferred from circumstantial evidence, including emails, recorded statements, or discrepancies in paperwork. Even honest mistakes can appear suspicious when reviewed out of context.

Potential Criminal and Financial Penalties

Penalties depend on the severity of the alleged fraud. Misdemeanor cases may result in fines and probation, while felony charges can lead to imprisonment, restitution orders, and permanent criminal records. Beyond legal penalties, professional licenses, employment opportunities, and personal reputations are often affected, creating long-term consequences that extend far beyond the courtroom.

The Critical Role of an Insurance Fraud Attorney

When facing allegations, an insurance fraud attorney evaluates every detail of the case, from how evidence was gathered to whether investigators respected constitutional rights. Early involvement allows defense counsel to prevent clients from making damaging statements and to begin building a strategic response immediately.

Evaluating Evidence and Protecting Constitutional Rights

Legal professionals in this field focus on several key areas. First, they analyze whether the prosecution can truly establish intent. Miscommunication, clerical errors, or incomplete documentation may create reasonable doubt. Second, they scrutinize the investigative process. If law enforcement conducted unlawful searches or obtained statements improperly, that evidence may be challenged or excluded.

Negotiation and Alternative Resolutions

Negotiation also plays a significant role. In certain circumstances, legal counsel may secure reduced charges, alternative sentencing, or diversion programs. For first-time offenders, especially, avoiding a conviction can protect long-term career and financial stability.

Managing Communication With Insurers

Another vital function involves managing communication. Insurance companies often conduct internal investigations before criminal charges are filed. Statements given during these reviews can later be used in court. Having representation ensures that rights are protected from the earliest stages.

Auto Insurance Claim Investigations

Insurance fraud allegations frequently arise from automobile claims. These cases may involve staged collisions, inflated repair estimates, or exaggerated injury reports. Because accident claims are common, insurers closely monitor inconsistencies and patterns that suggest potential deception.

Health and Medical Coverage Disputes

Medical insurance cases sometimes center on billing disputes, alleged unnecessary procedures, or documentation inconsistencies. Complex coding systems and administrative errors can complicate matters, making it essential to separate intentional misconduct from clerical mistakes.

Property and Homeowners Claim Scrutiny

Property and homeowners claims can also trigger investigations, particularly after fires, floods, or theft reports. When significant payouts are involved, insurers may examine financial history, prior claims, and even personal relationships to determine whether fraud may have occurred.

Disability and Workers’ Compensation Reviews

Disability and workers’ compensation cases are another frequent source of scrutiny. Surveillance footage, employment records, and social media posts are often used as evidence to suggest claimants misrepresented their physical condition. Even minor inconsistencies between medical reports and daily activities can become focal points for prosecutors.

Business and Corporate Fraud Allegations

In more complex situations, businesses may face allegations of submitting false claims, misclassifying employees, or manipulating coverage information. These cases often involve substantial financial records and forensic accounting analysis, requiring an in-depth legal and financial defense strategy.

Defense Strategy: Challenging Intent

Building a strong defense requires more than denying allegations. One common approach focuses on lack of intent. Demonstrating that errors were unintentional or based on misunderstanding can significantly weaken the prosecution’s argument. Documentation showing consistent communication with insurers or reliance on professional advice can be powerful evidence.

Questioning Witness Credibility

Another strategy involves challenging witness credibility. In many cases, accusations originate from insurance adjusters, investigators, or even former associates. Cross-examining these individuals may reveal bias, incomplete investigations, or procedural errors that undermine the prosecution’s case.

The Role of Expert Testimony

Expert testimony can also influence outcomes. Medical professionals, financial analysts, or accident reconstruction specialists may provide interpretations that counter the prosecution’s narrative. By presenting clear and supported explanations, defense counsel can establish reasonable doubt before a judge or jury.

Considering Plea Agreements Carefully

Plea negotiations are sometimes considered when evidence appears strong. However, accepting a plea without fully understanding long-term consequences can be risky. An experienced insurance fraud attorney helps clients weigh options carefully, balancing immediate outcomes with future implications.

Why Early Legal Intervention Is Crucial

Many individuals underestimate the seriousness of fraud investigations until charges are formally filed. Unfortunately, by that point, damaging statements may already exist. Early representation allows attorneys to advise clients before interviews, document submissions, or recorded calls that could later be used in court.

Preserving Critical Evidence

Prompt action enables preservation of favorable evidence. Emails, text messages, and financial records may support an individual’s explanation but could be lost over time. Early legal guidance ensures that critical information is secured and organized effectively for defense preparation.

Long-Term Career and Reputation Risks

A fraud conviction extends beyond fines or jail time. Many employers conduct background checks, and a criminal record can severely limit career prospects. Professional licenses in fields such as healthcare, finance, or real estate may be suspended or revoked, making the consequences both professional and personal.

Financial Impact Beyond Court Penalties

Financial consequences are also significant. Courts frequently order restitution, requiring repayment of alleged losses. Civil lawsuits from insurance companies may follow, seeking additional damages. The cumulative financial burden can become overwhelming without proper legal strategy.

Selecting the Right Legal Advocate

Choosing defense counsel requires evaluating experience in white-collar crime, familiarity with insurance regulations, and a history of handling complex investigations. Communication style, available resources, and strategic planning capabilities all influence the effectiveness of representation.

Conclusion: Protecting Your Future With Strategic Defense

Facing fraud allegations can feel overwhelming, but informed action provides clarity and control. Strong legal advocacy ensures that your constitutional rights are respected, that evidence is carefully examined, and that every strategic option is considered. An insurance fraud attorney not only defends against charges but also works to protect your career, finances, and reputation from lasting harm. Taking immediate steps toward professional legal guidance can make the difference between temporary legal trouble and permanent life consequences.

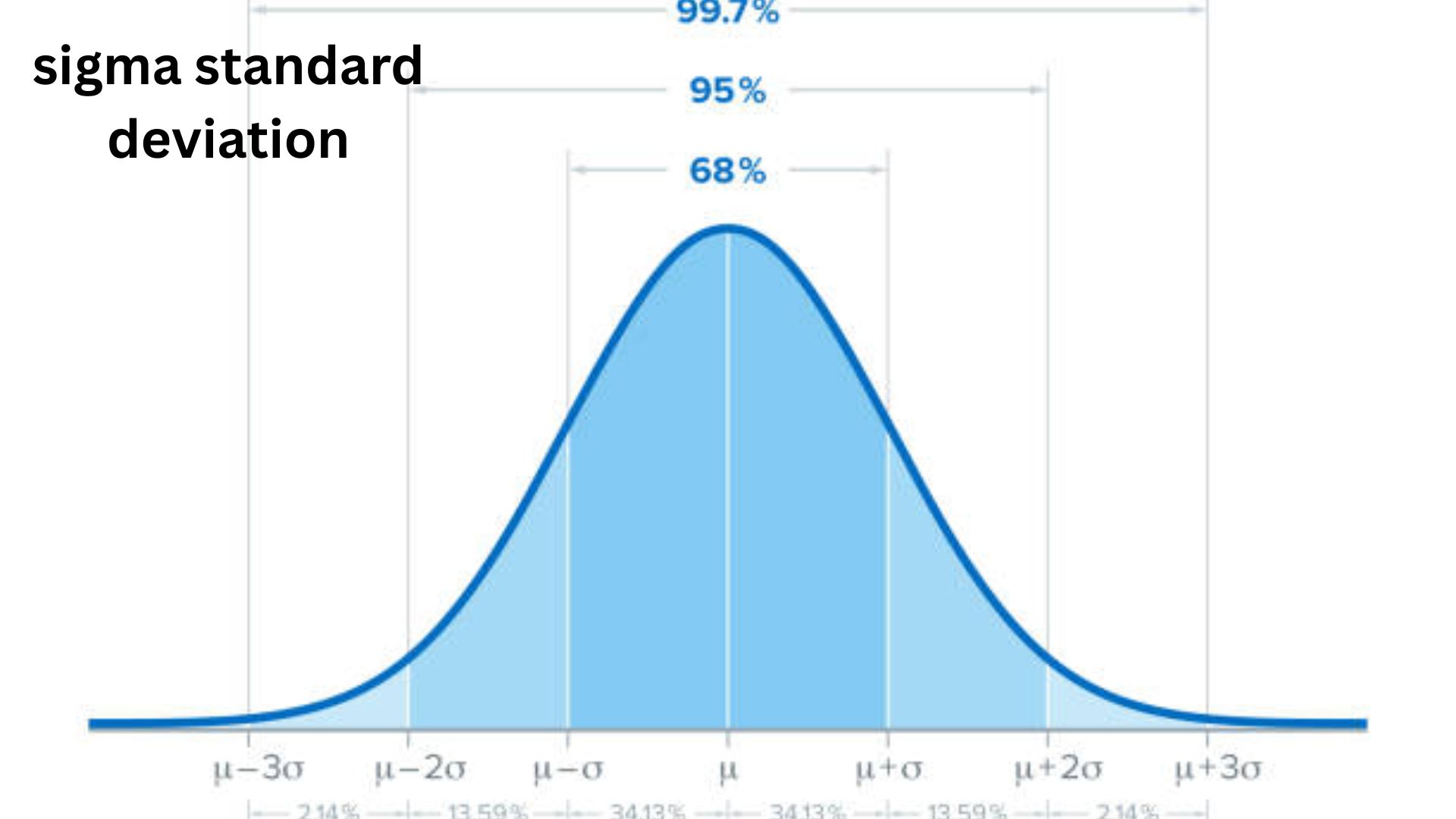

Also read: Sigma Standard Deviation: A Simple Guide of Data Spread